I can give you a list of 10 reputable loan companies in the USA as of my most recent knowledge update in September 2021. Remember that the lending environment is dynamic, so you should do your homework before making any financial decisions. The top 10 loan companies in the USA are listed below, along with some information about each:

Bank of America:

One of the biggest banks in the US, Wells Fargo, provides a range of loan products, such as mortgages, auto loans, and personal loans.

They offer online banking services and have a sizable branch network.

Depending on the type of loan, different loan terms, interest rates, and eligibility requirements apply.

Chase JPMorgan:

Another significant US bank offering credit cards, mortgages, auto loans, and personal loans is JPMorgan Chase.

They provide online and in-person banking services.

The specific loan type and the creditworthiness of the borrower determine the loan’s terms and interest rates.

Loans from Discover Personal:

Discover provides personal loans for a range of needs, including debt relief, home improvement, and more.

They offer competitive interest rates and a simple online application process.

Depending on the borrower’s credit and financial situation, loan terms and amounts can change.

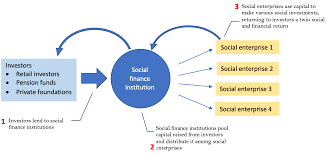

Social Finance (SoFi):

SoFi is renowned for its online lending platform, which provides investment services, mortgages, student loan refinancing, and personal loans.

They concentrate on offering affordable prices and cutting-edge features.

Borrowers with good credit and solid financial profiles are frequently drawn to SoFi.

LendingClub:

Peer-to-peer lending platform LendingClub links borrowers and private investors.

They provide a platform for loan applications online and offer personal loans for a range of needs.

Terms and interest rates are based on the loan’s specifics and creditworthiness.

Goldman Sachs Marcus

Goldman Sachs’ consumer banking division, Marcus, provides savings accounts and personal loans.

They offer flexible-term, fixed-rate personal loans with no fees.

Online applications are accepted for loans.

American Bank

Personal loans, home equity loans, and auto loans are just a few of the different loan products that U.S. Bank provides.

They have physical branches all over the country and offer online banking services.

Depending on the type of loan and the borrower’s qualifications, loan terms and rates change.

bank PNC:

Personal loans, home equity loans, and other financial services are offered by PNC Bank.

They run branches in numerous states and provide online banking services.

The specific loan type and the applicant’s information determine the loan’s terms, amounts, and rates.

Peoples’s Bank

Personal loans, mortgages, and other financial services are available from Citizens Bank.

They have locations across several states and offer an online application process.

The loan type and the applicant’s creditworthiness determine the loan’s terms and rates.

Financial OneMain:

Personal loans are OneMain Financial’s area of expertise. These loans can be used for a variety of things, including debt consolidation and unplanned expenses.

They have physical locations all over the nation where customers can get help in person.

Borrowers with lower credit scores might find OneMain to be more accessible.

Please be aware that the information presented here is based on data that was available as of September 2021, and that since that time, the lending environment may have changed. Before making any financial decisions, always do your homework, read reviews, compare rates and terms, and double-check the facts with the lender.